Key Components of a Digital Storefront

Streamlining Your Checkout Process

Picture this: your customer has found the perfect product, added it to their cart, and is ready to check out. But suddenly, the process feels clunky, slow, or worse—untrustworthy. Don’t let your digital storefront become a revolving door where customers leave mid-purchase!

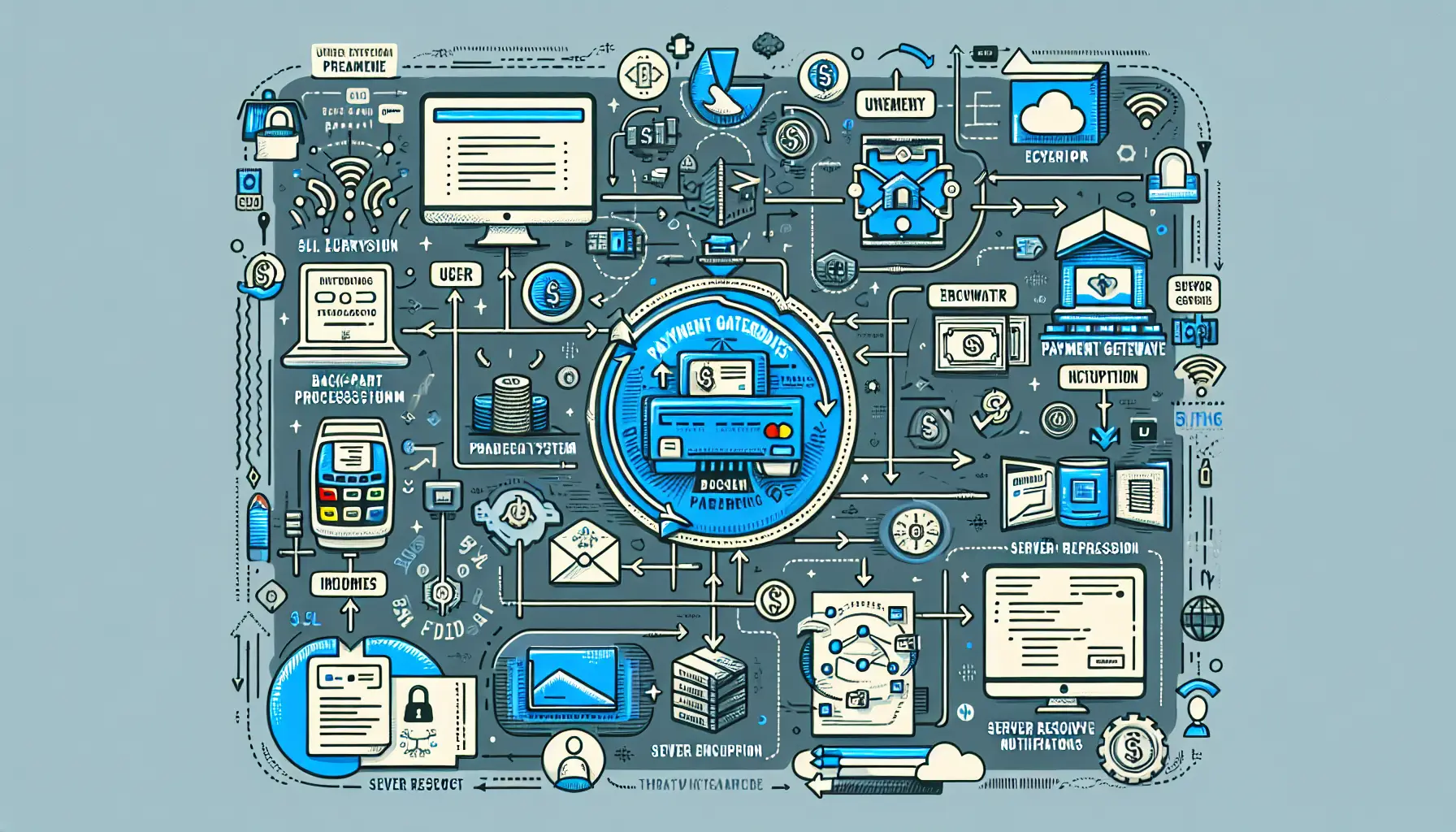

A well-integrated

payment gateway is your secret weapon here. It’s not just about processing payments; it’s about creating a seamless, trustworthy experience that whispers, “You’re in safe hands.” Imagine offering multiple payment options like credit cards, PayPal, or even Apple Pay—all while keeping the interface intuitive and lightning-fast.

Here’s what a rock-solid checkout process should include:

- Transparent Costs: No surprise fees popping up at the last second. Keep it clean and clear.

- Speed: A fast-loading payment page ensures customers don’t lose patience—or confidence.

- Security: Features like SSL encryption and PCI compliance tell users their data is untouchable.

Think of your payment gateway as the friendly cashier who greets customers with a smile and makes the entire experience feel effortless. That’s the vibe you want—smooth, secure, and downright delightful!

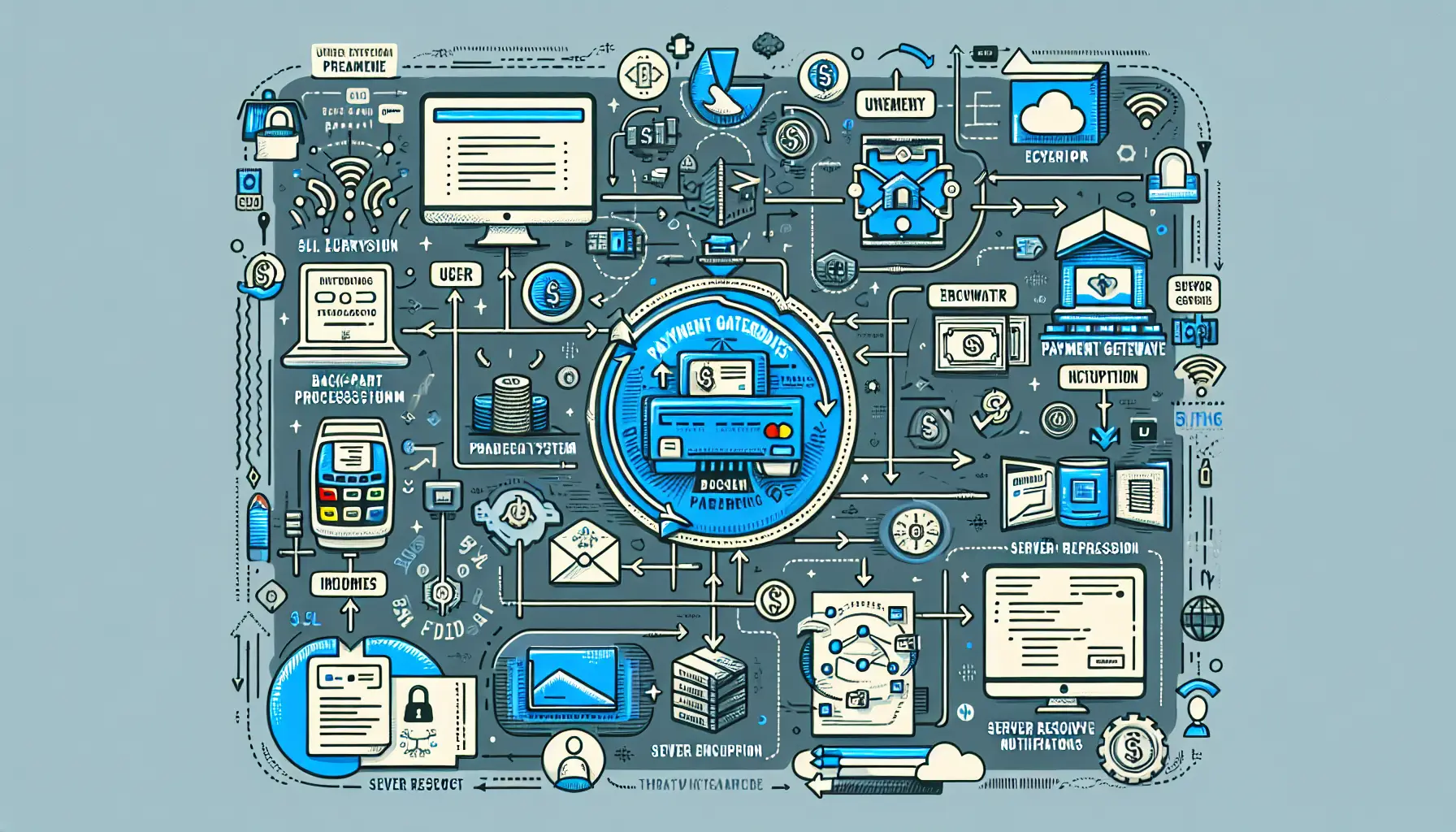

Importance of Secure Payment Gateways

Why Secure Payment Gateways Are Your Digital Storefront's Guardian Angel

Imagine your online store as a cozy boutique on a bustling street. Customers wander in, excited to browse, but what if they hesitate at checkout? That’s where a

secure payment gateway becomes your shop's trusty lock and key, ensuring every transaction feels safe and seamless.

A robust payment gateway isn’t just about encryption and fancy tech; it’s about trust. Think of it as the invisible handshake between you and your customer. It whispers, “Your credit card details are safe here,” and that whisper can make all the difference in turning a visitor into a loyal buyer.

Here’s why you need to care:

- Fraud protection: It’s not just about stopping hackers. A secure gateway actively monitors and detects suspicious activity before it reaches you.

- Data compliance: You’re not just protecting your customers; you’re safeguarding your reputation by adhering to regulations like PCI DSS.

Picture this: without a secure system, every sale could feel like walking a tightrope without a net. With the right payment gateway, your store becomes a fortress—welcoming, yet impenetrable. Isn’t that the peace of mind your business deserves?

Step-by-Step Guide to Building a Digital Storefront

Why Payment Gateways Are the Beating Heart of Your Online Store

Imagine your digital storefront as a bustling café. Customers are pouring in, eyeing your beautifully crafted products, and when they’re ready to buy, they head to the counter. That counter? It’s your

payment gateway. Without it, transactions come to a screeching halt—like a barista with no coffee beans.

A solid payment gateway does more than just process payments; it builds trust. Shoppers need to feel confident that their sensitive data is safe with you. Think of it as the digital equivalent of a friendly cashier who handles their money with care. To make this happen, look for these key features:

- Encryption: Keeps customer data locked tight and secure.

- Multi-currency support: Welcome buyers from all corners of the globe.

- Fraud protection: Shields you and your customers from cyber threats.

Choosing the right gateway isn’t just a technical decision; it’s about creating a seamless, worry-free experience for your shoppers. After all, no one likes a hiccup at checkout—it’s like spilling your latte just before that first sip!

Best Practices for Integrating Payment Gateways

Crafting Seamless Payment Experiences

Imagine walking into a store where the checkout process is a breeze—no fumbling for cash, no awkward pauses. That’s exactly the vibe you want for your digital storefront when integrating a

payment gateway. This isn’t just about transactions; it’s about trust, ease, and making your customers feel valued.

A strong payment integration can be the backbone of your business. Here are some essentials to focus on:

- Speed: Slow-loading gateways can make customers abandon their carts faster than you can say “lost sale.” Choose a solution that zips through payments like a sports car on an open road.

- Security: Think of this as the unbreakable lock on your store’s front door. Features like encryption and fraud detection keep both you and your customers safe.

- Flexibility: Whether it’s credit cards, digital wallets, or BNPL (Buy Now, Pay Later), offering multiple options keeps everyone happy.

When done right, your payment gateway becomes invisible—a silent hero ensuring smooth sailing for every customer journey. It’s not just tech; it’s the secret handshake that builds loyalty.

Future Trends in Digital Storefronts and Payment Security

The Shifting Landscape of Digital Transactions

Imagine your digital storefront as a bustling marketplace. Customers wander in, eager to shop, but what keeps them coming back? One word: trust. In the world of online payments, that trust hinges on how seamlessly and securely you handle transactions. Today, with technology racing ahead like a sprinter, payment gateways aren’t just tools—they’re the heartbeat of your business.

What’s exciting is how these systems are evolving to meet modern demands. Here’s a glimpse of what’s shaping the future:

- Biometric authentication: Fingerprints, face scans—your body becomes your password. Forget fumbling for codes!

- Tokenization: Sensitive card data is replaced with unique tokens, making it nearly impossible for hackers to grab anything useful.

And don’t even get me started on the rise of AI-driven fraud detection! Picture a digital watchdog, tirelessly scanning every transaction for red flags. It’s not just about staying secure—it’s about staying ahead.

The takeaway? Your payment gateway isn’t just a back-end feature. It’s your invisible handshake with every customer, ensuring their experience feels effortless and safe.